… More Months Go By … More Conventions Cancelled …

A series of four free webinars, presented online

by BI Mid-Michigan Chapter and Manifest Investing

This series of four webinars will be offered as a partial replacement for some of the sessions originally scheduled for BINC (BetterInvesting National Convention) which has been indefinitely postponed … due to the pandemic.

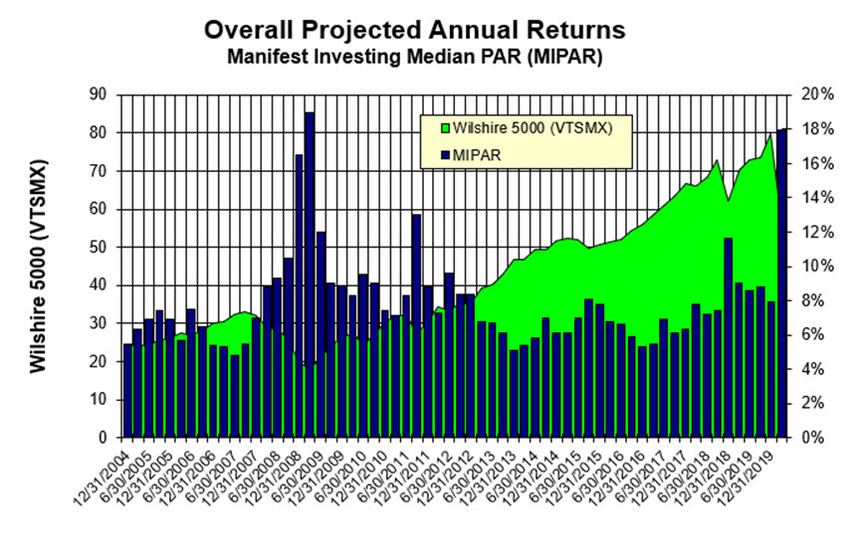

As the accompanying image of Tahquamenon Falls in Michigan’s upper peninsula suggests, we like to take a moment, Give Thanks, and celebrate that a colorful horizon lies ahead while we nod knowingly that this year has been a challenge. This is not the first time we’ve seen this movie. Stock markets have been surging and turbulent in the wake of a pandemic and the path ahead includes uncertain inflation effects and a variety of vision-impacting conditions. That said, we again envision a break in the clouds, a reliable burst of color on many of our landscapes and better days ahead. The pandemic includes an outbreak of event cancellations and there’s no more succinct way to express what we think about that. “We miss all of you.”

In that spirit, we’re building Successful Investing IV — a compendium of investing discussions intended to characterize the current challenges and demonstrate the discovery of opportunity. We’ve been through similar challenges in the past and the key is remembering what-we-do and what-really-matters and never forget that there’s always opportunities for long term investors.

Registration: You must register separately for each session; sign up for as many of the (4) sessions as you wish, using the registration URL listed with each session in the FULL SCHEDULE information below. Upon registering, you will receive a confirmation email with your access information. Use the information in the confirmation email to enter the webinar at the appropriate time.

Alternate registration sites are available at manifestinvesting.com and https:www.betterinvesting.org/chapters/mid-michigan/local-events.

Recordings: The sessions will be recorded and posted after the sessions to the Manifest Investing YouTube channel at https://www.youtube.com/user/manifestinvest/videos; you do not need to register to view the recordings.

FULL SCHEDULE (Times listed are for Eastern Daylight Time.)

Session 1: Stock Pickers, Groundhogs & Long-Term Investing (Ken Kavula, Mark Robertson)

Date: Wednesday – November 10 — 2 PM – 3:30 PM EDT

Registration: https://register.gotowebinar.com/register/4721899283424002573

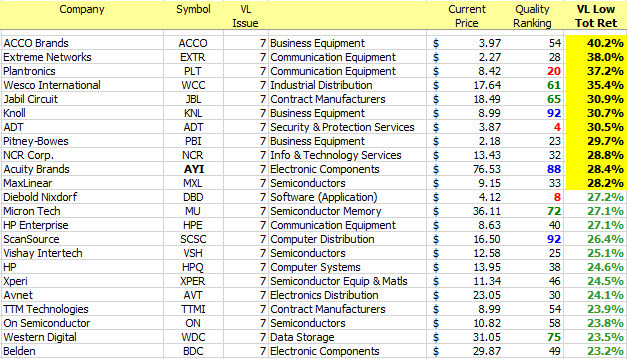

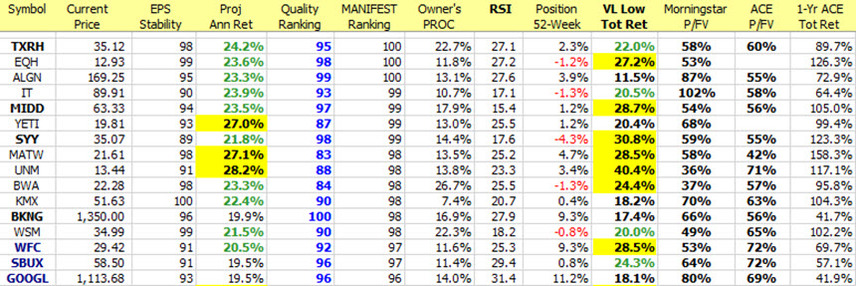

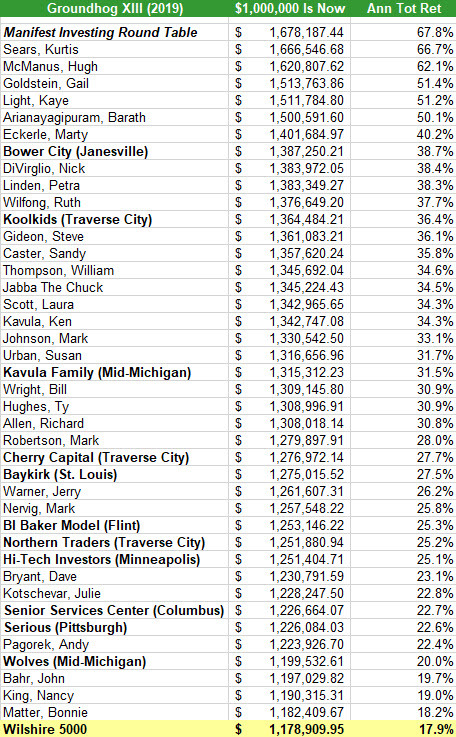

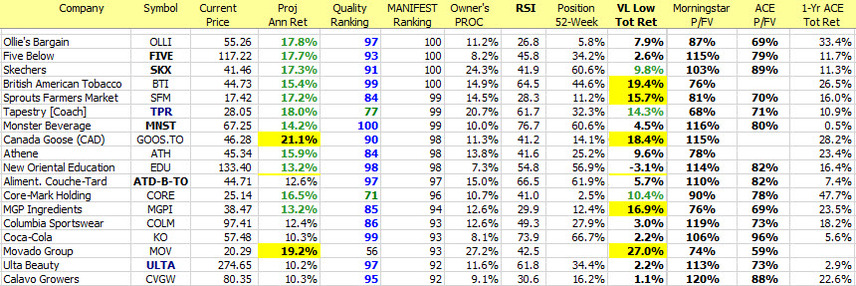

This class will cover the results of the nineteenth annual Mid-Michigan Stockpickers’ Contest. We’ll celebrate the winners and the losers, examine some of the strategies used by the clubs to reap profits and recognize excellence in stock picking. We’ll also look at the Manifest Investing Groundhog contest and show how it can be mined as a rich source of ideas. The class will demonstrate that it doesn’t necessarily take a portfolio filled with exotic names to beat the market.

Session 2: 20 Questions — Investing & Investment Clubs (Ken Kavula, Cy Lynch, Mark Robertson)

Date: Wednesday — November 10 — 4 PM – 5:30 PM EDT

Registration: https://register.gotowebinar.com/register/6212031108665399053

Have you ever played 20 questions? This class aims to discover new ways of becoming a Better Investor and to reinforce tried and true investing behaviors. Our questions will be gathered from club visits Mark, Ken and Cy have made over the years, from questions that our audience has submitted and from questions that commonly arise as we travel the country teaching BetterInvesting methods. We hope the session will prove to be enlightening, entertaining and educational.

Session 3: Finding & Profiting From Small Companies (Ken Kavula, Mark Robertson)

Date: Thursday — November 11 — 2 PM – 3:30 PM EDT

Registration: https://register.gotowebinar.com/register/6936851163928269325

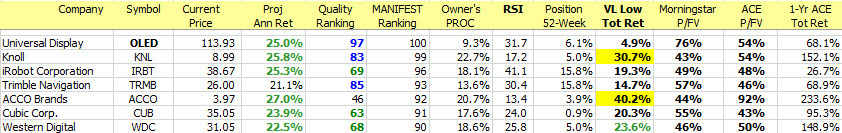

Every year near the end of October Mark and Ken examine the best small companies. Their track record of beating the market with their list of investable companies with revenues under $1.5B or thereabouts is impressive. Join them a they unveil their picks for 2021-22.

Session 4: Let’s Talk Stock: Stock Ideas NOW! (Kim Butcher, Ann Cuneaz, Pat Donnelly, Charlene Hansen, Ken Kavula, Cy Lynch, Mark Robertson)

Date: Thursday, November 11— 8 PM – 9:30 PM EDT

Registration: https://register.gotowebinar.com/register/1142104927665262349

What happens when you gather seven of the best Stockpickers in our community on a single panel and ask them for great ideas? If you are lucky and listening hard you might get some of the best ideas in your investing career. Past panels have brought you winners like NEOG, ILMN, SLP, VEEV and ARNA. We hope some of you listened last fall as STNE, FIVE and EPAM were presented as great ideas for investing. What will we hear this year? We don’t guarantee all winners but we do think you will be entertained and informed. Join us and listen carefully.

Kim Butcher is a Lifetime member of BetterInvesting and a BetterInvesting National Convention Presenter as well as a Round Table Presenter for Manifest Investing . She is currently a member of 2 investment clubs and one being “Bionic”, an online club that has members from the East to the West coast. Her love of teaching began during her career as a nurse over 30 years ago. She is also a past member of the BetterInvesting Volunteer Advisory Board (BIVAB).

Ann Cuneaz is the Education Program Senior manager at BetterInvesting. Ann manages a variety of educational programs designed to help BetterInvesting Members become successful long-term investors, including First Cut Stock Reports, StockUp, TickerTalk, Online Stock Studies, Introduction to the Stock Selection Guide Series (SSG Series), Adding Judgement Series and more. Ann has been a member of BetterInvesting since 1998 and a founding partner of two investment clubs. Previously she was an active volunteer at the local, regional and national level since 2001. Ann holds a Bachelor of Science degree from the Michigan State University.

Pat Donnelly is president of the Pittsburgh Chapter having worked in several positions within the Chapter and previously served on the Better Investing Volunteer Advisory Board. Recently Pat has been elected to the Better Investing National Board of Directors. Pat is proudly married to Sue Donnelly and together they have two great kids. During the day, Pat is a cloud infrastructure technology consultant. Besides finding great stocks, learning from the great volunteers, he likes to learn and share about the many no-cost computer based resources available to the individual investor. Tools that are available to everyone, some of them built right into your computer. When time permits after that Pat is revisiting his interest in sailing.

Ken Kavula (kkavula1@comcast.net) has served the modern investment club movement in a wide variety of leadership volunteer positions. He is a Nicholson award winner, a retired educator and is regarded as a small company champion and respected speaker nationwide. You might have heard him teaching on the TickerTalk program for BetterInvesting. Before retirement, Ken served as Principal of Genesee HS for 21 years. He lives with his wife Natalie near their two children and five grandchildren and he also belongs to four investment clubs, including two Model clubs and a family club. Ken and Natalie are avid theater goers and travel as much as they can.

Charlene Hansen resides in Elk Rapids, Michigan, with her husband, Dennis, a retired Kroger Executive, and is a Director for the Mid-Michigan Chapter of BetterInvesting. Elk Rapids lies just north of Traverse City and is also the home to one of Mid-Michigan’s Model Clubs. Charlene is the President of this this club known as POVIC (Port of Value IC). POVIC has about 15 members, both men and women. In addition to her investing activities, she serves on the Elk Rapids Harbor Commission. Charlene enjoys golf, painting, reading and travel.

Cy Lynch (celynch@att.net) is a respected and experienced long-term investor and educator. He has served in a number of regional and national volunteer capacities and currently serves on the Better Investing Board of Directors. Among his many vocational roles include investment advisory and service as a lawyer. He recently was ordained as a Baptist Minister. He is a Lifetime member of Better Investing. Cy is a frequent contributor at MANIFEST, providing regular educational topics and a knight of the Round Table series. Cy and his wife, Barb, are enthusiastic advocates for animal rights.

Mark Robertson (markr@manifestinvesting.com) is founder and Managing Partner of Manifest Investing, served as senior contributing editor for Better Investing and has worked with successful investment clubs and individual investors since 1993. He has appeared on National Public Radio, CNBC and ABC to discuss long-term investing. He has also worked with Smart Money, Barron’s, Money magazine and the Motley Fool and been covered by the Chicago Tribune, Wall Street Journal and MarketWatch as well as a number of local publications.

What we do is different.

The modern investment club movement was a big tent … and a considerable bandwagon. Unfortunately, people’s capitalism and the stewardship of common stock OWNERSHIP has hit a bit of a speed bump, or worse. It’s pretty clear that some WD-40 is needed. The results achieved by the persistent are compelling. But too quiet.

What we do is different. We have no problem with things like discounted cash flow analysis — we believe that we’re chasing fewer variables and that SIMPLER is usually better when it comes to the realm of investing.

“Mathematics is ordinarily considered as producing precise and dependable results; but in the stock market the more elaborate and abstruse the mathematics the more uncertain and speculative are the conclusions we draw therefrom. In forty-four years of Wall Street experience and study I have never seen dependable calculations made about common-stock values, or related investment policies, that went beyond simple arithmetic or the most elementary algebra. Whenever calculus is brought in, or higher algebra, you could take it as a warning signal that the operator was trying to substitute theory for experience, and usually also to give to speculation the deceptive guise of investment.” — Benjamin Graham, The Intelligent Investor

Amidst the chaos, turbulence and avalanche of information, we find it rewarding and seemingly more reliable to focus on growth, profitability and valuation in a different kind of model. As is often the case, events like a prior Morningstar Investment Conference serves to remind about the value of being simple … and different.

The audience gasped when Keith Lee of Brown Capital Management confessed that in over 25 years of successful investing that he’s never owned a financial sector stock. In his own words, Brown is “sector benchmark agnostic.” Brown Small Company (BCSIX) has a 10-year relative return of +1.5%.

Cathie Wood and ARK Investing (ARKK) have a relative return of +17.4% since 2014.

Keith Lee and Brown Capital Management and Cathie Wood and ARK Investing are different. We like different.

The Mid-Michigan Chapter of Better Investing is an outstanding example of community investing. Known as a “chapter” that operates on behalf of the National Association of Investors, the goal is to share the potential of long-term investing with as many individuals as possible. A network of investment clubs and individual investors has been admirably served by a talented team of educators and counselors for decades. The excellence runs deep — centered on the time-honored lessons of the modern investment club movement for the past 80 years. The chapter runs a steady series of educational programs and supports the development of regional and nationwide opportunities for sharing. We’re better together.

Manifest Investing is a web-based investing system including research and features/tools for stock and fund screening as well as resources for portfolio design and management. The resources are completely based on our interpretation of the lessons learned, methodologies, techniques and disciplines promulgated by the modern investment club movement. The intent is to serve do-it-yourself investors, small groups of portfolio managers known as investment clubs and to support the efforts of those who want to work in a more informed manner with their professional investing advisors. The community and content stream generates a continuous flow of actionable ideas. We seek and deliver “elegant simplicity” by focusing on a small number of factors and characteristics that really matter. Features and regular webcasts (e.g. monthly Round Table, weekly Bull Sessions) feature demonstrations of analysis and methods. Our focus is on demystifying investing — particularly when it comes to the design and management of a portfolio — enabling anyone to experience successful investing with their personal investing or retirement plans. We endorse and encourage investment clubs as vehicles for support and group learning.

If you’d like a FREE test drive of http://www.manifestinvesting.com to explore and experience the origins of community-driven actionable ideas, send your request to markr@manifestinvesting.com The annual subscription is $40/year — a special offer that will expire at the end of the month. The annual subscription will be $79 after that.